Govt, Banks Loan Less To Latino-Owned Businesses

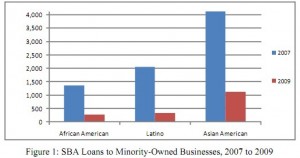

The California Reinvestment Coalition recently released a report entitled, “Small Business Access to Credit: The Little Engine That Could” that found from 2007 to 2009 the Small Business Administration severely cut the number of loans made to Latino- and minority-owned businesses. In California the SBA cut funding to Latino-owned businesses by 84%, even while big Wall Street firms were being bailed out by the government!

The California Reinvestment Coalition recently released a report entitled, “Small Business Access to Credit: The Little Engine That Could” that found from 2007 to 2009 the Small Business Administration severely cut the number of loans made to Latino- and minority-owned businesses. In California the SBA cut funding to Latino-owned businesses by 84%, even while big Wall Street firms were being bailed out by the government!

No access to loans means these businesses run a greater risk of folding in these tough economic times. and, as the report points out, “These businesses are particularly critical because they are more likely to be in neighborhoods with fewer businesses and are more likely to hire people of color who experience much higher unemployment rates.” So, when the SBA doesn’t lend to Latino-owned businesses, communities of Latinos suffers, as do would-be Latino employees. That’s called a ripple effect, right?

But it gets worse. The report goes on to note that five major banks — Bank of America, CitiBank, US Bank, Union Bank, and Wells Fargo — also decreased their lending to minority-owned businesses during this time period. For Latinos, this decrease was 89% — the highest of all the minority groups. Although this is just a sample of California’s business, it is a state with very significant numbers of Latinos, and thus likely indicative of a trend across the country.

But it gets worse. The report goes on to note that five major banks — Bank of America, CitiBank, US Bank, Union Bank, and Wells Fargo — also decreased their lending to minority-owned businesses during this time period. For Latinos, this decrease was 89% — the highest of all the minority groups. Although this is just a sample of California’s business, it is a state with very significant numbers of Latinos, and thus likely indicative of a trend across the country.

You don’t have to be Latino to know that the entrepreneurial spirit is strong in Latin American countries, so the fact that the government and the banks have pulled back support for these businesses during the recession is a strong sign that the SBA and banks do not take Latino interests at heart. We reported recently that Latinas open businesses at a rate six times the national average; when you consider all the facts, you begin to run out of explanations as to why this could be if it’s not deliberate.

[Images Courtesy velkr0; California Reinvestment Coalition]